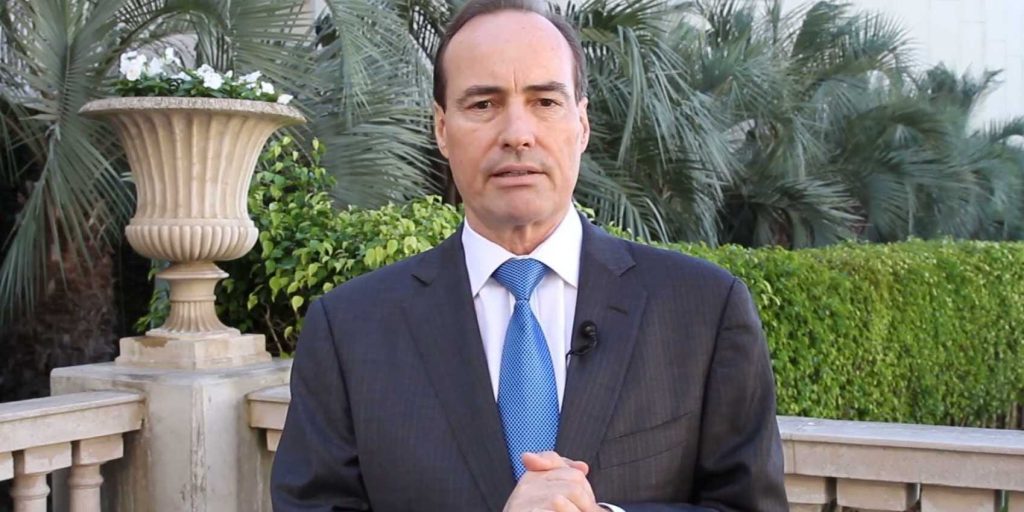

- Author Harry Dent said the Federal Reserve has created the biggest asset bubble in history.

- The market historian predicted a painful crash in stocks and an economic depression.

- Dent trumpeted multifamily real estate and long-dated Treasury bonds as excellent bets today.

Excessive stimulus has inflated asset prices to such heights that a brutal market crash and painful economic depression are inevitable, Harry Dent told "Rich Dad Poor Dad" author Robert Kiyosaki in a recent episode of Kiyosaki's radio show.

"You can't just print money and grow an economy past its fundamentals," the market historian and newsletter writer said. "They just bubbled up financial assets," he continued, referring to the Federal Reserve.

Dent accused the Fed of artificially shoring up the US economy since the onset of the financial crisis nearly 15 years ago. He asserted the US government's aid packages during the COVID-19 pandemic only exacerbated the problem.

"The fact that after the $10 trillion in combined fiscal and monetary stimulus in two years after COVID, we are already falling in a recession again — if that doesn't tell you something's wrong, you better wake up," he said.

The author of "The Great Depression Ahead" diagnosed "the greatest bubble in history," and claimed that stock prices have already peaked.

"We had this first crash, a tepid bounce, and now we'll have another one of the same magnitude," he said, adding that he expected the Nasdaq to tank by over 40% to 7,350 points by the end of this year or early 2023.

Meanwhile, Dent framed an economic slump as a positive and desirable development.

"You know what recession is to me? Sleep," he said, arguing the economy needs to cool down, bad debts have to be restructured, and the worst companies must be weeded out. "I'm happy to see a downturn."

"This is not going to be a recession," he clarified. "It's going to be a mini depression that'll take a couple years to work out."

Dent — the founder of HS Dent Investment Management, Dent Research, and HS Dent Publishing — also framed a market crash as a chance for young people to invest at reasonable prices, earn solid returns, and save for retirement.

Kiyosaki's guest recommended investing in multifamily real estate and long-dated Treasury bonds before asset prices crash. He asserted that residential buildings such as duplexes and apartment blocks not only produce income, but could see higher demand if the housing market collapses and home financing dries up. Meanwhile, he trumpeted government bonds as havens until better opportunities emerge.

Finally, Dent predicted inflation would peak around 10%, then cease to be a concern for at least half a century. He also compared bitcoin to Amazon during the dot-com bubble, suggesting the most popular cryptocurrency could lose virtually all of its value before surging to far greater heights in the future.